Unveiling the Benefits: Federal Tax Incentives on Solar Energy in Florida

Solar energy has emerged as a game-changer in the pursuit of clean and sustainable power sources. To encourage the adoption of solar systems, the federal government offers a range of tax incentives that significantly reduce the financial burden for homeowners and businesses.

In Florida, where abundant sunshine can be harnessed effectively, understanding how these federal tax incentives work is essential for those seeking to embrace solar energy and its numerous advantages.

In the article below, we will explore the intricacies of federal tax incentives on solar energy in Florida and the benefits they offer.

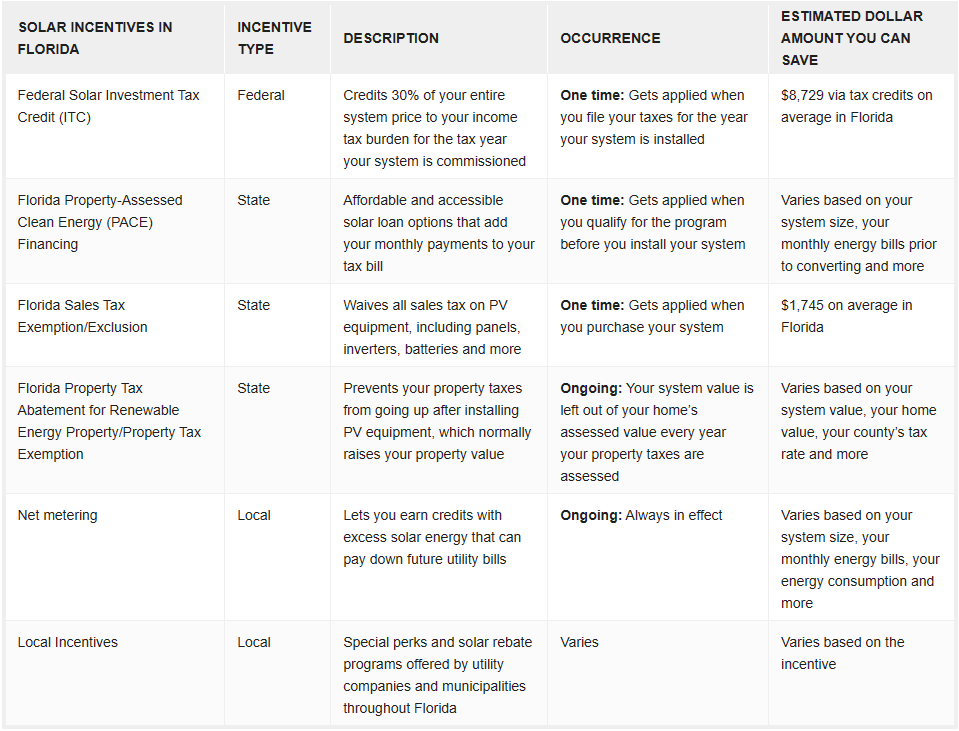

A list of all of the federal, state and local incentives that are available to Floridians.

What Do Floridians Need to Know About the Federal Solar Tax Credit?

The federal solar investment tax credit (ITC) is the most substantial financial incentive available for PV systems in Florida. It’s offered by the federal government and is available to all Florida homeowners. The federal credit is for 30% of your entire system cost. In Florida, where residents pay an average of $29,095 for an average 11.5 kilowatt (kW) system, the credit amount comes out to around $8,729.

This amount gets applied to the income taxes you owe for the year your system is installed. If you can’t take the full credit that year, you can roll over any remaining credit for up to five years. The federal credit was originally offered in 2005 according to the following rate schedule:

30% of the system value for systems installed between 2005 and 2021.

26% of the system value for systems installed in 2022.

22% of the system value for systems installed in 2023.

0% of the system value for systems installed in 2024 and beyond.

Thankfully, the credit was extended in 2022 and increased back up to 30%. It’s now available according to the following rate schedule:

30% of the system value for systems installed between 2022 and 2032.

26% of the system value for systems installed in 2032.

22% of the system value for systems installed in 2033.

0% of the system value for systems installed in 2034 and beyond.

What You Need to Know About the Florida Property-Assessed Clean Energy (PACE) Financing

PACE financing is a solar loan program offered by the state of Florida. Rather than a traditional loan, this program requires a minimal down payment and keeps interest rates below the market average. It also seeks to make loan repayment as simple as possible by adding your monthly payment to your tax bill. The goal of PACE financing is to make solar financing accessible to demographics found typically ineligible, and it’s really geared more toward lower-income households. However, eligibility is open to all Florida residents.

The average savings you can enjoy with this program are hard to calculate because there are so many moving parts and factors that can affect your system total, financing costs and long-term system totals. However, the average savings for a financed system in Florida totals around $15,500, so this is about what you can expect to see in lifetime energy savings.

What You Need to Know About the Sales Tax Exemption in Florida

The sales tax exclusion in Florida waives all sales tax on solar photovoltaic equipment, including panels, inverters, solar batteries, electric vehicle (EV) chargers, racking equipment and the installation costs.

This solar tax exemption is applied at the point of sale, where you’ll save the average state sales tax of 6%.

With the average system price in the Sunshine State hovering around $29,095 (before any credits or rebates), that’s an average of $1,745 you’ll save on your total system price.

Keep in mind that this is reflected in your total price quoted by your installation company, so you will not get this as a cash-back incentive or tax credit.

What You Need to Know About the Property Tax Exclusion in Florida

The property tax exclusion in Florida prevents your property taxes from increasing as a result of installing solar panels.

Usually, when you carry out a home improvement that boosts your property value, your assessed value and your taxes go up with the value. Converting to solar panels makes your home more valuable— an increase of around 4.1%, on average — but the exemption prevents this from having an effect on your taxes.

It’s difficult to calculate the dollar amount of this incentive, as it depends on your system value, the value of your home and the tax rate in your area.

With a statewide tax rate average of 0.98% and a typical system value of $29,095, it’s expected that this perk will save you around $285 per year on your tax bill.

Over the life of your system, an estimated 20+ years, that comes out to a total savings of approximately $5,700.

Powering a Brighter Future with Clean Energy.

Where to Reach Us

Address: 520 Valencia St, Sanford Florida 32771

Phone: (407) 235-6274

Email: [email protected]